Disclaimer: The opinions expressed here are for general informational purposes only and are not intended to provide specific advice or recommendations for any specific security or investment product. You should never invest money that you cannot afford to lose. Before trading using complex financial products, please ensure to understand the risks involved. Past performance is no guarantee of future results.

Picture this: the new iPhone 17 Ultra Pro Max just dropped, and you’re debating whether or not to switch up your mobile device. The new holographic display makes the purchase hard to refuse, but the hefty price tag stops you from laying down the cash without a second thought.

Now, what if a friend was buying it? Let’s say he’s a frugal fellow but is extremely impressed with this iPhone in particular. Would that sway you to buy? How about if multiple friends or family members also made the purchase?

What if your purchasing decisions systematically took into account those of your peers?

Over the past summer, I’ve been working on this exact idea, but towards trading algorithms instead of Apple products — and I’ve got some surprising results to show you all over the next few blog posts!

But first…

Meet the Data Science Team

As a part of the Data Science (DS) Team here at Tuned, we provide insights, support our engineering team, and explore potential opportunities for innovation. We’ve grown to a team of 3 members in just a couple of months, with the goal of providing greater value to Tuned and all the traders we service.

If you’re not familiar with Tuned, our platform is used by thousands of traders to create and run high performing strategies, who can then provide access to trading signals generated from those strategies with other traders (i.e., investors) for a fee.

The DS team started off with Christiaan, our Chief Information Officer. Christiaan’s been with Tuned since 2019, designing our platform and planning our roadmaps. He also helps out the community (you’ve probably seen him around our Discord), works on data science, requirements, operational excellence, and supports our day-to-day management of the business.

Next up, we have Alec, our Director of Analytics. He’s been spearheading the development of our data stack, which started with the launch of our Redshift analytics warehouse. He’s implementing a number of tools to increase data access across the organization that support our product, operations and growth initiatives.

And then there’s me! Hi, I’m Albert and I’ve been a Data Science Intern here at Tuned for the past 2 months. Along with supporting our DS team by generating visualizations and writing queries, I’ve been working on an exciting project to investigate how we can improve the performance of Tuned strategies!

Here’s the idea

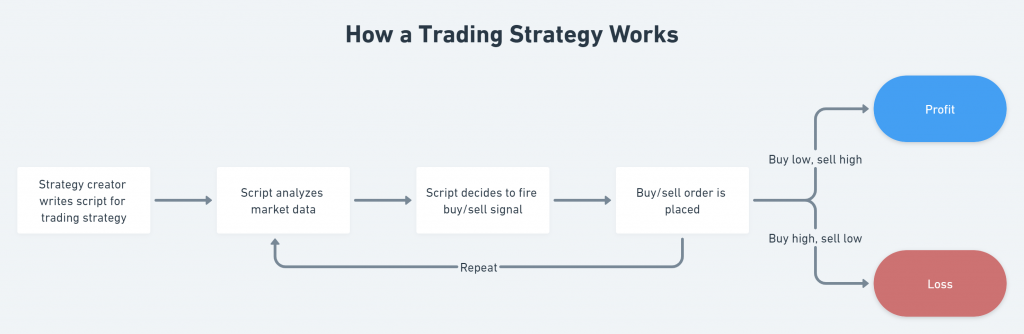

Say we have two automated trading strategies, strategy A and strategy B. Each strategy is backed by a script (think of an instruction manual), which analyzes market data and tells the strategy when to buy and when to sell. These decisions for when to buy or sell are called signals. For example, when a script decides to fire a buy signal, the strategy will execute a buy order of, say, Bitcoin. Strategy creators aim to program scripts that generate profitable signals — ones that buy low and sell high.

Here’s the hypothesis: what if we only executed a buy order if both strategies A and B fired a buy signal at (or around) the same time? Just like our friends who also decided to buy the new iPhone, what would happen if we only buy when other parties are also buying? Could this give us a better return?

That’s the question I’ve been tackling during the past 8 weeks, by coding clustering algorithms and diving into the data we’ve collected…

A Note on Data Collection and Privacy

As mentioned earlier, Alec helped set up our data analytics warehouse on Redshift. To answer my inquiry question, I’ve been querying data from Redshift, from buy and sell signals to market data and orders from strategies, via the HeidiSQL client.

While our warehouse stores a ton of data, there’s a lot of data we don’t collect either. We don’t have access to the proprietary code written by strategy creators — script ownership rests solely with their creators. The warehouse also doesn’t store personally identifiable information (PII) like names or emails. We value the privacy and efforts of our creators and only use the data we need to provide a better experience to all users.

What’s Our Goal?

At Tuned, we strive to help everyone attain higher returns by helping creators build superior algos. We do this by investing in R&D and innovating on the cutting edge of financial markets and algo trading.

My project, to combine signals from different strategies to improve performance, has the potential to further separate Tuned from any other platform. If we can discover strategies that synergize well, we’ll be able to create more powerful tools for creators to leverage, which will lead to better-performing syndications for investors! As such, we believe that every party involved benefits from these efforts.

For transparency, I’ve been working on a purely exploratory analysis. We haven’t applied the findings of this project yet, nor have we made money through this in any way. Part of turning this research into a product will be an “opt-in” system, allowing every creator on Tuned to participate. We are currently still deepening our research before starting any implementation. Stay tuned for future developments and potential applications in our upcoming posts!

What’s Next?

In the next article, I’ll be diving deep into my analysis and present some exciting results, including unexpected pairs of strategies that combine together for some pretty terrific returns. See you there!

Creating Better Trading Strategies — The Future

And here we have it: the last installment of the data science article series! In…

Creating Better Trading Strategies — The Results

Welcome back, data science fans! Continuing from the second article, where I discussed the clustering…