Disclaimer: The opinions expressed here are for general informational purposes only and are not intended to provide specific advice or recommendations for any specific security or investment product. You should never invest money that you cannot afford to lose. Before trading using complex financial products, please ensure to understand the risks involved. Past performance is no guarantee of future results.

Today we are excited to share more about our vision for Tuned. We’ve set out to level the playing field between Wall Street and the independent trader, by helping everyone power their investment portfolios with trading strategies developed by quantitative traders. Here’s why we think this is important:

In the last decade, we’ve seen a major shift in how consumers interact with traditional industries. Where consumers were once forced to depend on behemoth corporations for everyday services, they can now look to individuals and small businesses to get similar and often better products and services. The toppling of monolithic regimes led to more flexibility, options, and cost savings for consumers. Industries shaken by AirBnB, Uber and Shopify, looked untouchable at one point not too long ago.

We are now witnessing the next frontier for innovation – finance. To date, much of what we’ve seen from fintech is the evolution of existing products and services as they move online. Personal banking moved from in-person banking to mobile based banking, which leveled the playing field for new entrants and challenger banks. We saw wealth management evolve into online services known as robo advisors such as Wealthfront and Betterment. Stock trading moved from expensive online brokers to no-fee mobile trading products like Robinhood and Chime.

In each of these examples, traditional technologies were wrapped in easy to use interfaces. However, true disruption is more than an interface, it is the complete rebuilding of an industry from the ground up with the aim to spread benefits and new opportunities more broadly. Rather than just making markets more accessible, we should also look to impact how returns are distributed.

In the case of emerging stock trading apps, retail traders are pitted against professional traders leveraging high frequency trading algorithms where milliseconds matter and machine learning models trained on decades worth of market data. Does this sound like an even playing field where benefits are truly being passed on to the consumer? At Tuned, we don’t think so.

We look to address three core problems

- Access to the highest returns are generally reserved for the well-to-do via hedge funds, where participation is invite-only and often require $1M minimum investments.

- Delivering consistent and predictable returns relies on technological innovation, including access to computing power, low-latency order management systems, machine learning and quantitative trading strategies, which are costly and difficult to build.

- The best quantitative traders are recruited by large banks, funds and institutions to service the wealth creation for a small few and follow the institutional agenda often influenced by politics and other factors.

We don’t have to look far to see how these problems affect real people. During the current health crisis, as we experience record unemployment and sweeping economic hardship, we’re bombarded by headlines describing how wealthy people are drastically increasing their net worths and the growing disparity gap between rich and poor. The contrast could not be more alarming. The difference between this small group and everyone else is largely driven by participation in markets. Markets are not inherently evil, they evidently create tremendous opportunities, however these opportunities are not evenly distributed – we look to change that.

Why our background sets us apart

Our founding team is not completely unfamiliar with this type of problem. At Facebook, we saw a very similar story play out with how the largest brands in the world would leverage the Facebook advertising platform with large budgets and deep ad buying expertise to rapidly grow their marketshare. Thankfully, Facebook had the foresight and the consideration to invest in helping small businesses extract the same value from the platform.

Unlike the new stock buying apps we see in the market, we didn’t expect these small businesses to succeed just by giving them access to the tools. Instead we completely rebuilt the tools from the ground up to give them an advantage. From simplifying the ads products, to using machine learning to help them improve their targeting, to developing easy-to-use products to create highly effective ad creative. We eliminated the need all together to be a media planner in order to unlock high performing campaigns on Facebook. We succeeded. In our time there we grew the number of advertisers from 3 to 8 million, which was largely driven by the products and services we built to service small businesses.

Now, we look to bring this same approach to capital markets. We are doing this by developing a two-sided business model. A business model that connects retail traders to the smartest quantitative traders in the world, while cutting out the middlemen charging high fees with discriminatory minimum investment requirements.

Our approach is simple

- Empower the top quantitative traders (also known as “quants”) to go independent by providing them ML-powered trading infrastructure to design, optimize, automate and license high performing strategies.

- Connect retail traders to high performing strategy syndications offered by quants, with verified performance and transparent pricing.

Today, Tuned is available for traders active in digital asset markets. We can offer this securely, without requiring traders to relinquish their assets by plugging directly into their existing trusted exchanges. In the near future, we plan to work with partners in equities, foreign exchange and other traditional and emerging asset classes to offer the same.

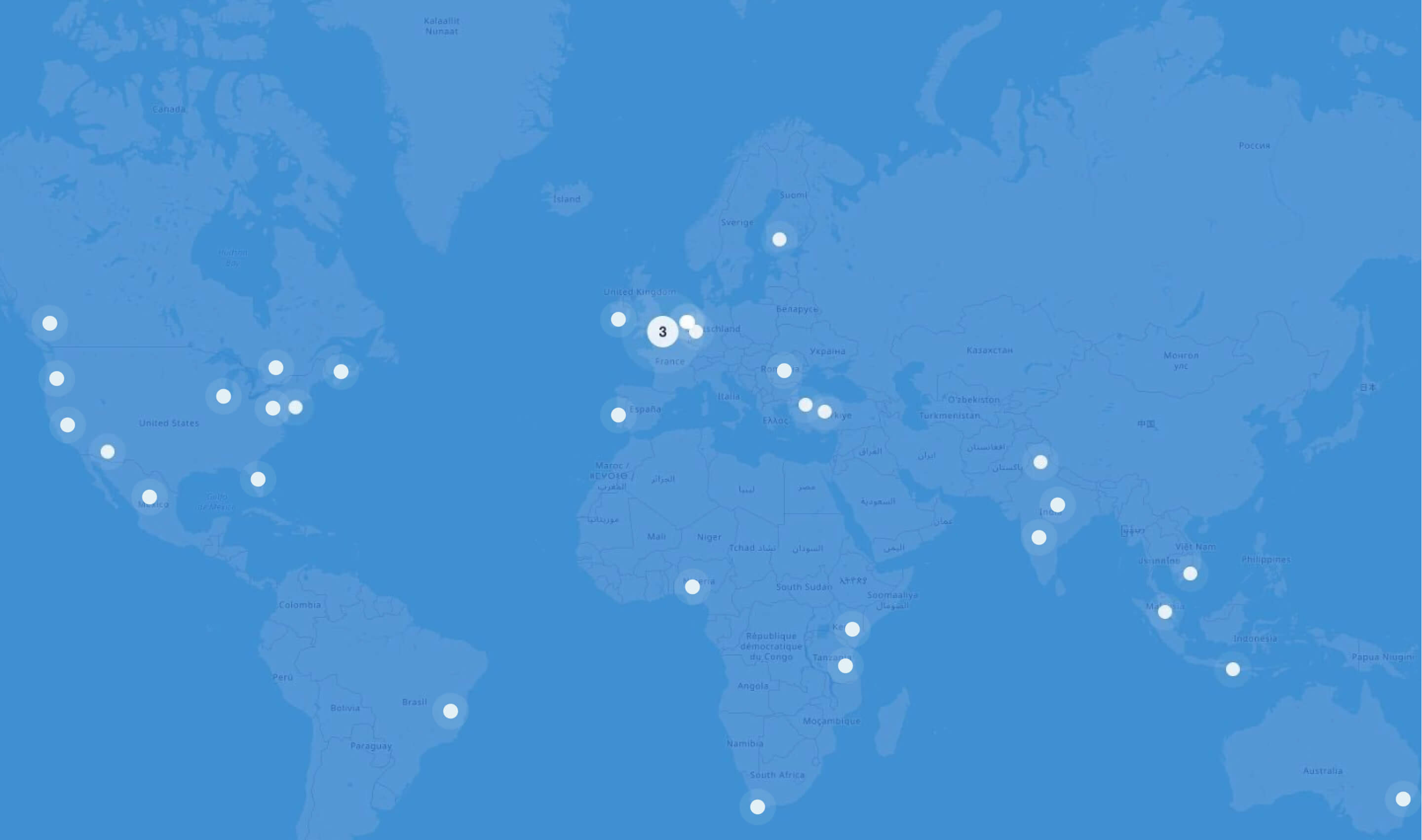

We are often asked whether we are competing in a market or creating one. You could say our competitors are the financial institutions and funds, because we’re keeping the most talented quantitative traders working for themselves. Creating a future where independent traders in Nigeria, Mexico, India and across the world can build successful trading businesses that may one day rival storied hedge funds of the present time, however unlike those funds, they will give all people access to the types of returns that can be derived from algorithmic and quantitative trading. Giving retail traders a new edge when participating in the same markets as the professionals.

Now, nothing can prepare you to launch a company in the middle of a social, health and economic crisis, but here we are and perhaps right on time. We’ve only just begun our journey and are already helping hundreds of traders around the world leverage the power of Tuned, while facilitating over $30M in monthly transaction volume.

If high finance is an empire, Tuned is arming the rebels.

Are you ready to join the revolution?

We are slowly rolling Tuned out to more traders. Sign up for our waitlist to get early access or visit Tuned.com to learn more.

Alkarim Nasser

CEO & Co-Founder

PS – Tuned is hiring! See all roles

Why Tuned is the Premier Automated Trading Platform

Our previous blog post, The Rise of the Independent Trader, talked about a plan to…